FTZ vs Bonded Warehouse vs Bonded CFS Entry: Smart Duty Deferral Strategies for China Imports in 2025

| Strategy | Best For | Timeframe | Cost Level | Setup Required |

|---|---|---|---|---|

| Foreign Trade Zone (FTZ) | High-volume importers with U.S. processing or assembly | Long-term | High | Yes (designation + CBP) |

| Bonded Warehouse | High-value goods, re-exports, slow-moving stock | Mid to Long | Moderate | Yes (CBP bonded facility) |

| Bonded CFS Entry | LCL shipments, short-term delays, transshipment | Short-term | Low to Moderate | No (via third-party CFS) |

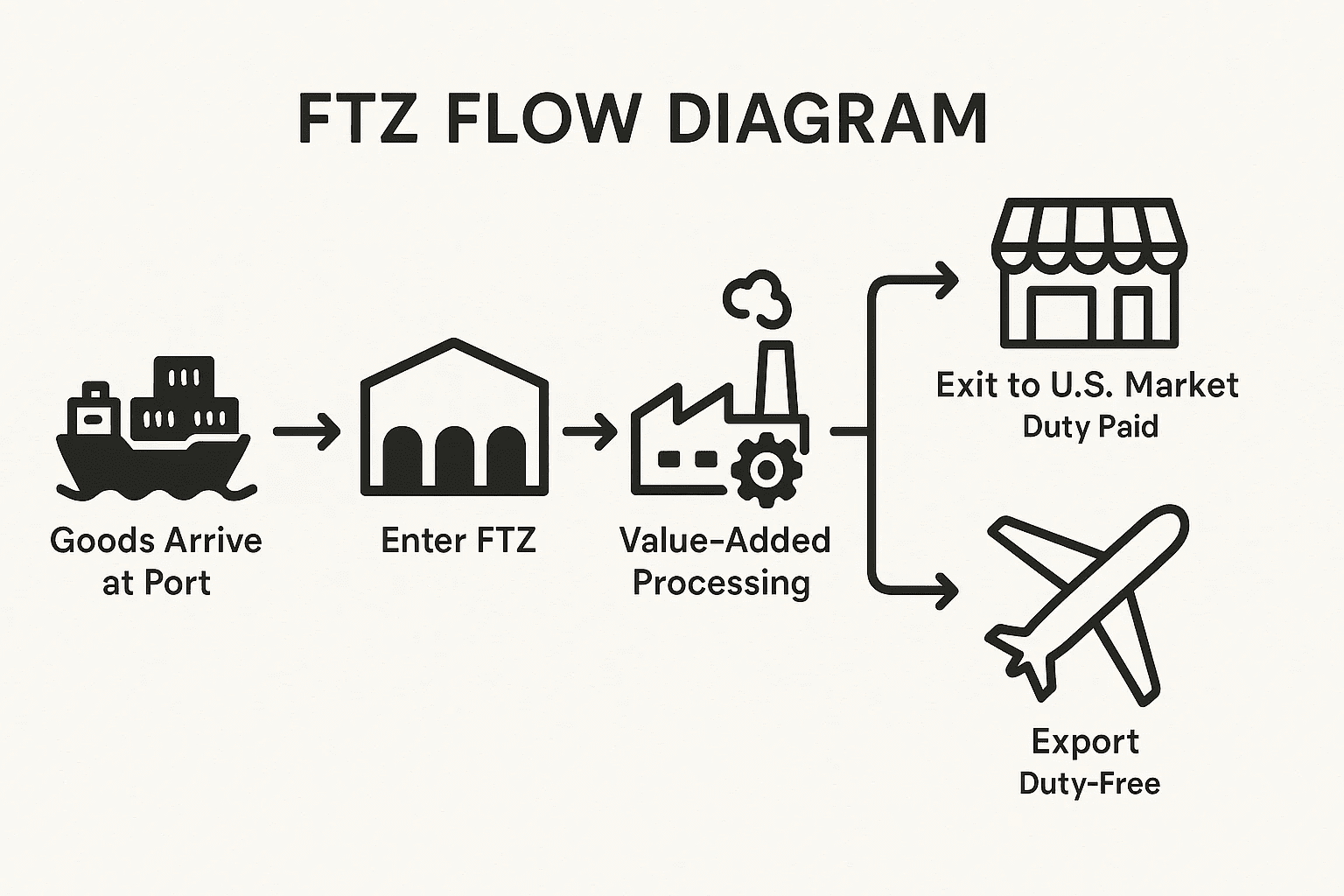

Foreign Trade Zone (FTZ)

Benefits:

- Deferred Duties: Customs duties are paid only when goods leave the FTZ and enter U.S. commerce.

- Duty Elimination on Exports: No duties are owed on goods that are re-exported from the zone.

- Weekly Entry Consolidation: Multiple shipments can be filed under a single entry, saving on brokerage fees.

- Inverted Tariff Advantage: Finished products with lower tariff rates than components qualify for the lower rate.

- No Duties on Scrap or Waste: Eliminates unnecessary duty payments on unusable materials.

Limitations:

- Requires formal activation, security protocols, and approval by U.S. Customs and Border Protection.

- Setup costs and compliance infrastructure may be too complex for low-volume operations.

- Prohibited from direct-to-consumer retail operations inside the zone.

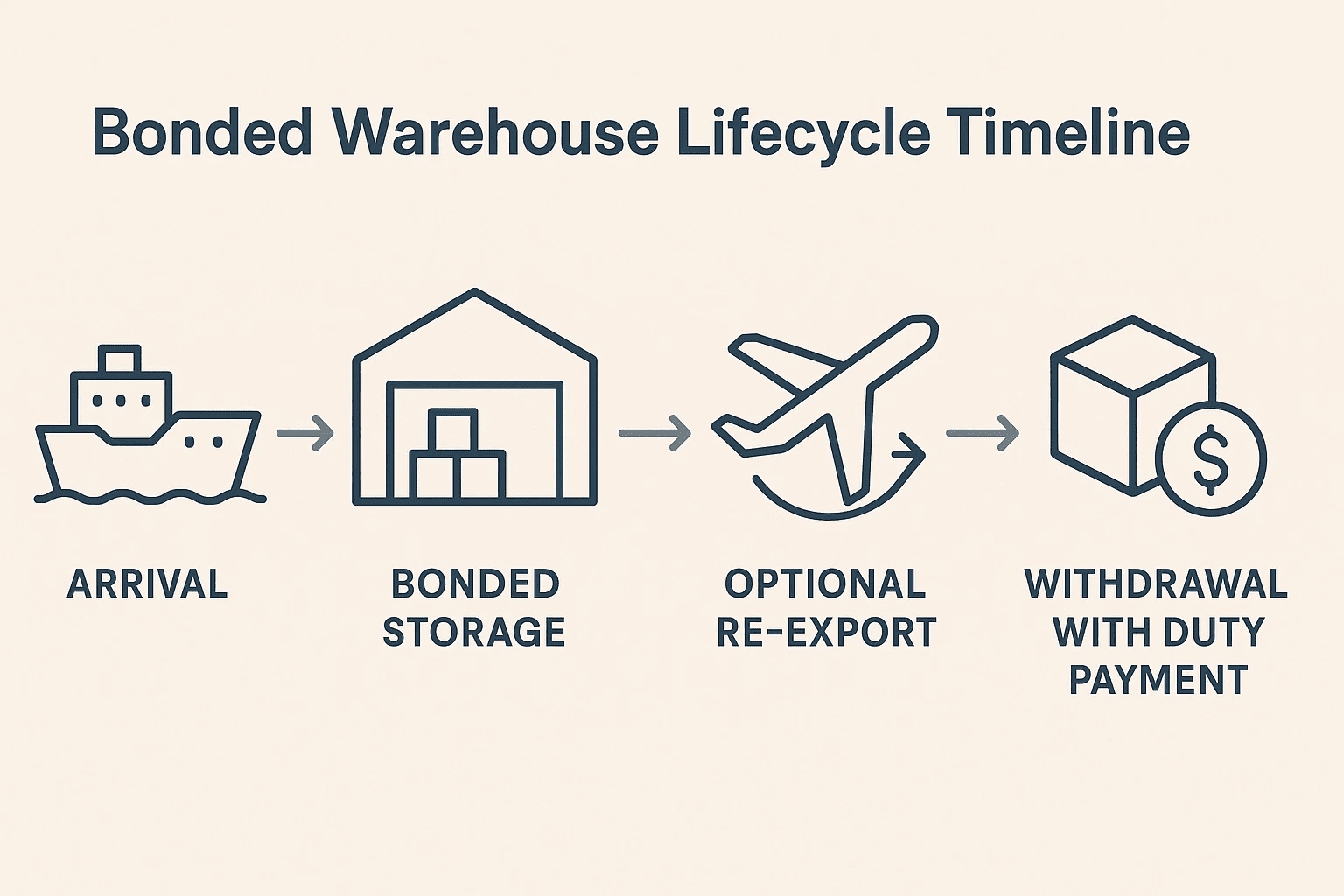

Bonded Warehouse Entry

Benefits:

- Long-Term Duty Deferral: Avoid upfront duty payments on inventory that may not sell immediately.

- No Duties on Re-Exports: Goods that are exported from the warehouse never incur U.S. duties.

- Defer Entry Filing: No need to file CBP Form 7501 until goods are withdrawn.

- Ideal for High-Value Inventory: Reduces the financial burden of storing expensive items.

Limitations:

- Withdrawal process requires bonded supervision and additional documentation.

- Not all ports or 3PLs have bonded warehouse facilities available.

- Storage costs can erode savings over long periods.

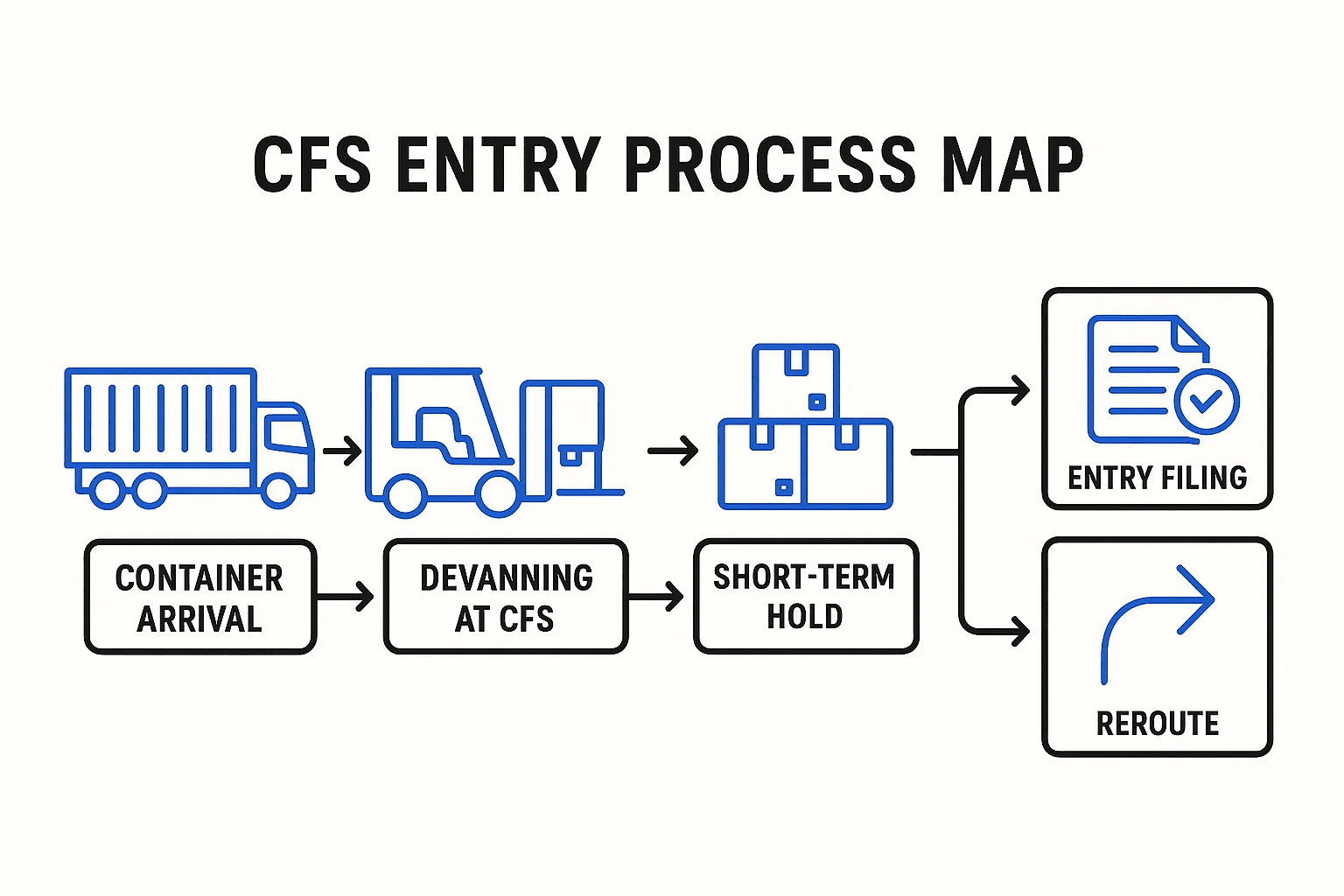

Bonded CFS Entry (In-Bond 7512)

Benefits:

- Duty Deferral: Delays customs entry and payment until the importer initiates clearance.

- Cost-Efficient for LCL Cargo: Best suited for shared-container shipments or partial loads.

- Low Setup Burden: No need to operate a bonded warehouse—use an authorized third-party CFS.

- Enables Transshipment: Ideal for rerouting or staging goods before final delivery.

Limitations:

- Typically limited to 15 days of storage time.

- Handling fees may be higher due to sorting and devanning.

- Less control over goods compared to FTZ or bonded warehouse options.

- Not suitable for long-term deferral strategies.

Additional Deferral Tools for Dedola Clients

- Port-Side Entry Delay: We can hold shipments at port for up to 15 days before initiating customs entry, offering tactical deferral without committing to warehousing (storage fees apply).

- ACH with Periodic Monthly Statement (PMS): Clients enrolled in PMS with CBP gain up to 45 days of extended duty payment time, improving cash flow and reducing administrative touchpoints.