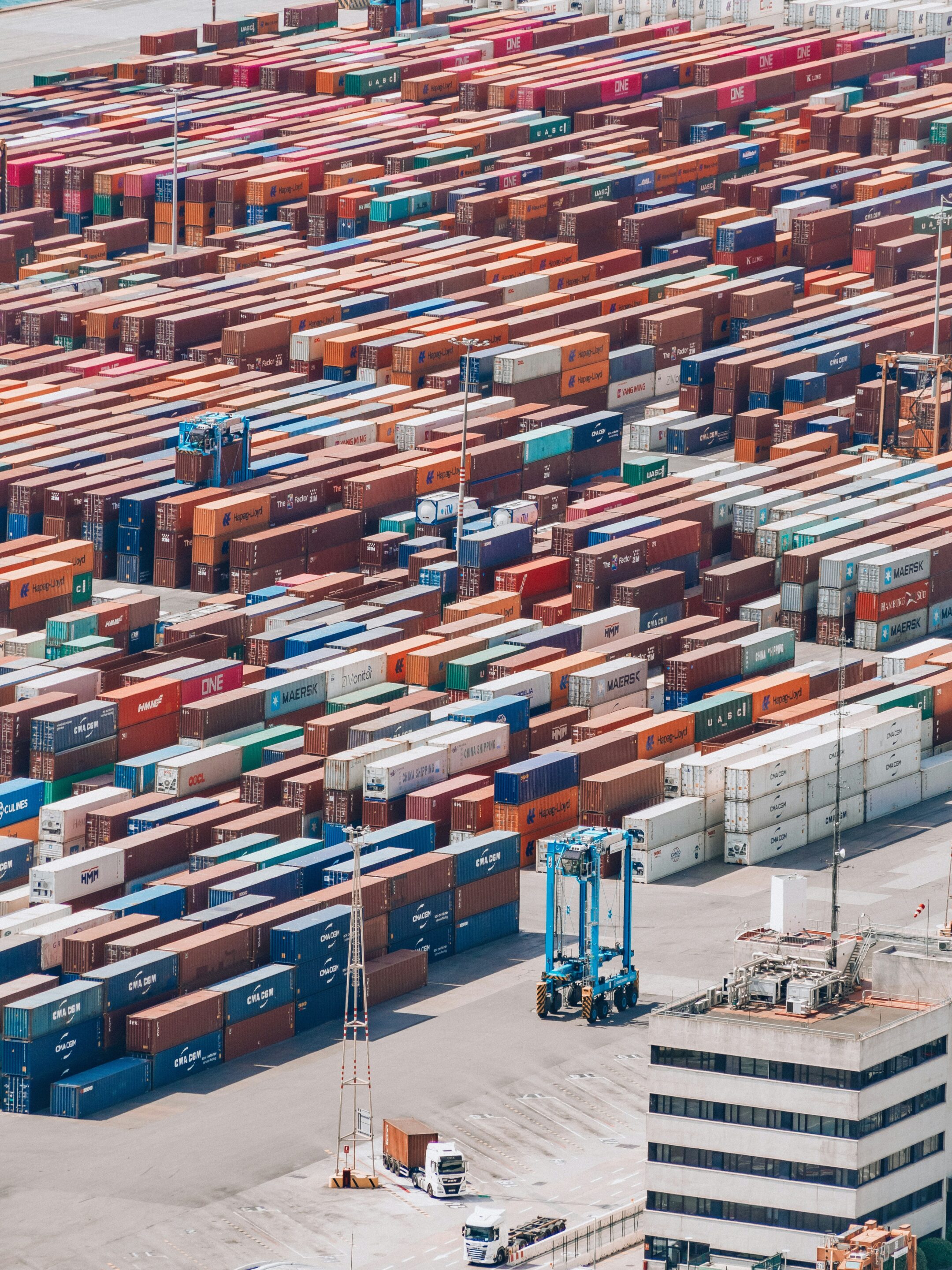

If you’re a U.S. importer bringing in general goods from China, April 2025 just changed the game.

What This Means for Importers of General Goods

- Your landed costs just increased. If you haven’t updated cost models or reviewed tariff exposure line by line, your margins may be eroding silently.

- Customs scrutiny is increasing. With broad policies in place, CBP is ramping up enforcement. Accurate HTS classifications, country-of-origin declarations, and clean documentation matter more than ever.

- Sourcing diversification is no longer optional. Importers that rely on a single origin face higher financial and compliance risk. Diversification is now a strategic necessity.

What About Steel, Fentanyl, and Other Headlines?

- Section 232 Tariffs (Steel & Aluminum): These remain in place and are now being more aggressively enforced. While less relevant to your products, they show increased Customs vigilance.

- Fentanyl-Related Tariffs (Feb/March 2025): These target Chinese chemical producers and illustrate the growing trend of using tariffs as political instruments—even outside of trade.

How Importers Are Responding (And How We Help)

3 Practical Steps to Take This Month

- Review all HTS classifications.

Even a small adjustment can lead to major tariff savings—or at least compliance clarity. - Audit your China exposure.

Are 80–100% of your shipments still tied to Chinese suppliers? If so, now’s the time to explore lower-risk sourcing. - Get proactive about documentation.

CBP is reviewing more shipments. The cleaner your paperwork, the faster your cargo clears.

You Can’t Control Tariffs. But You Can Control How You Respond