How Tariffs and Trade Regulations Impact the Aftermarket Auto Parts Industry — And How to Stay Ahead

Are You Losing Money on Tariffs Without Realizing It?

Every day, importers in the aftermarket auto parts industry lose thousands of dollars to tariffs—often without even realizing it. In 2023 alone, U.S. importers faced over $100 billion in tariff-related costs. Many of these expenses could have been avoided or significantly reduced through strategic planning.

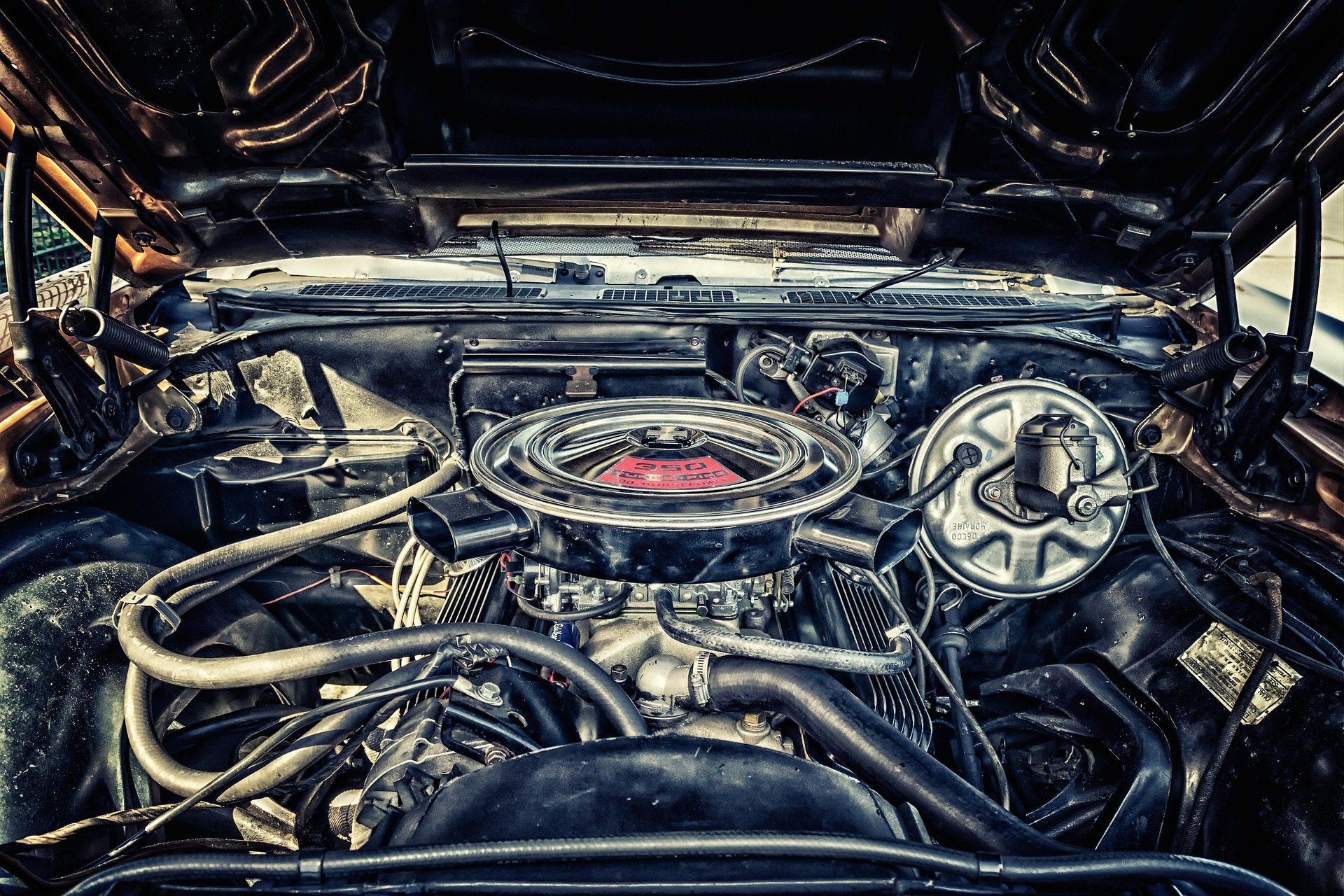

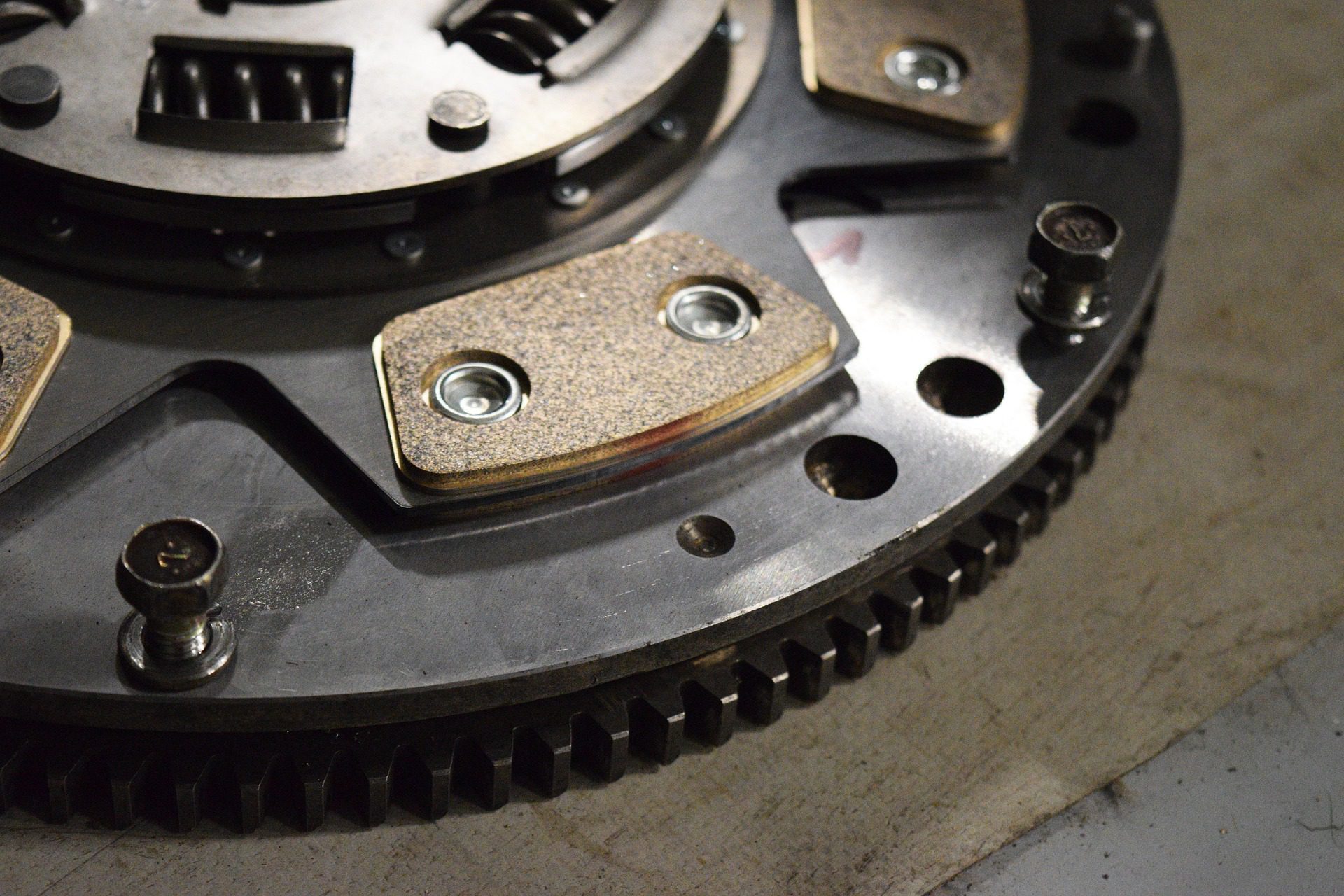

From suspension kits and brake components to performance upgrades, shifting trade regulations can lead to unexpected duties, shipping delays, and compliance penalties. The real challenge isn’t just staying informed—it’s knowing how to navigate these changes in a way that protects your margins and keeps you competitive.

Case Study: How One Auto Parts Importer Saved $50,000 in Tariffs—and Strengthened Their Supply Chain

At Dedola Global Logistics, we’ve helped countless auto parts importers turn trade challenges into cost-saving opportunities. Here’s how one client did it:

A U.S.-based importer specializing in aftermarket exhaust systems was blindsided by a sudden 25% tariff increase on key components. Their margins were at risk, and without a plan in place, they were staring down a six-figure hit to their annual budget.

Working with Dedola, they were able to:

- Recover nearly $50,000 in overpaid tariffs through a duty drawback program

- Reclassify certain items under lesser-known trade exemptions—legally reducing their duty rate

- Optimize routing to avoid unnecessary fees while maintaining on-time delivery

With the right strategy, they protected their bottom line and secured a long-term trade advantage—ensuring their pricing stayed competitive in a volatile market.

How to Minimize Tariff Costs and Stay Compliant

Avoiding costly surprises starts with a proactive approach:

- Monitor tariff changes before they impact your shipments

Trade regulations are constantly shifting. Having an expert in your corner means you’re always one step ahead. - Use duty drawback and tariff engineering

Many importers overpay without realizing it. Strategic classification and duty recovery programs can put money back in your pocket. - Ensure accurate documentation

Errors in customs paperwork lead to delays, fines, and shipment holds. Avoid this with clean, consistent documentation. - Partner with an experienced freight forwarder

With 50 years in international logistics, Dedola helps importers stay compliant, reduce costs, and move faster—no matter how complex the trade landscape gets.

Are You Paying More in Tariffs Than You Should?

What if a small change could save your company tens of thousands?

Many importers are unknowingly leaving money on the table—through missed opportunities for duty recovery, inefficient routing, or misclassified goods.

Let’s change that.

Schedule a free consultation today and let’s find ways to optimize your supply chain, reduce unnecessary tariff costs, and turn trade regulations into a competitive advantage.